The Sarasota Company issued 270000 of 9 bonds on January 1 2

The Sarasota Company issued $270,000 of 9% bonds on January 1, 2017. The bonds are due January 1, 2022, with interest payable each July 1 and January 1. The bonds are issued at face value.

Prepare Sarasota’s journal entries for (a) the January issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. (If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to 0 decimal places, e.g. 38,548.)

No.

Date

Account Titles and Explanation

Debit

Credit

| No. | Date | Account Titles and Explanation | Debit | Credit |

| (a) |

|

|

|

|

|

|

|

| ||

| (b) |

|

|

|

|

|

|

|

| ||

| (c) |

|

|

|

|

|

|

|

|

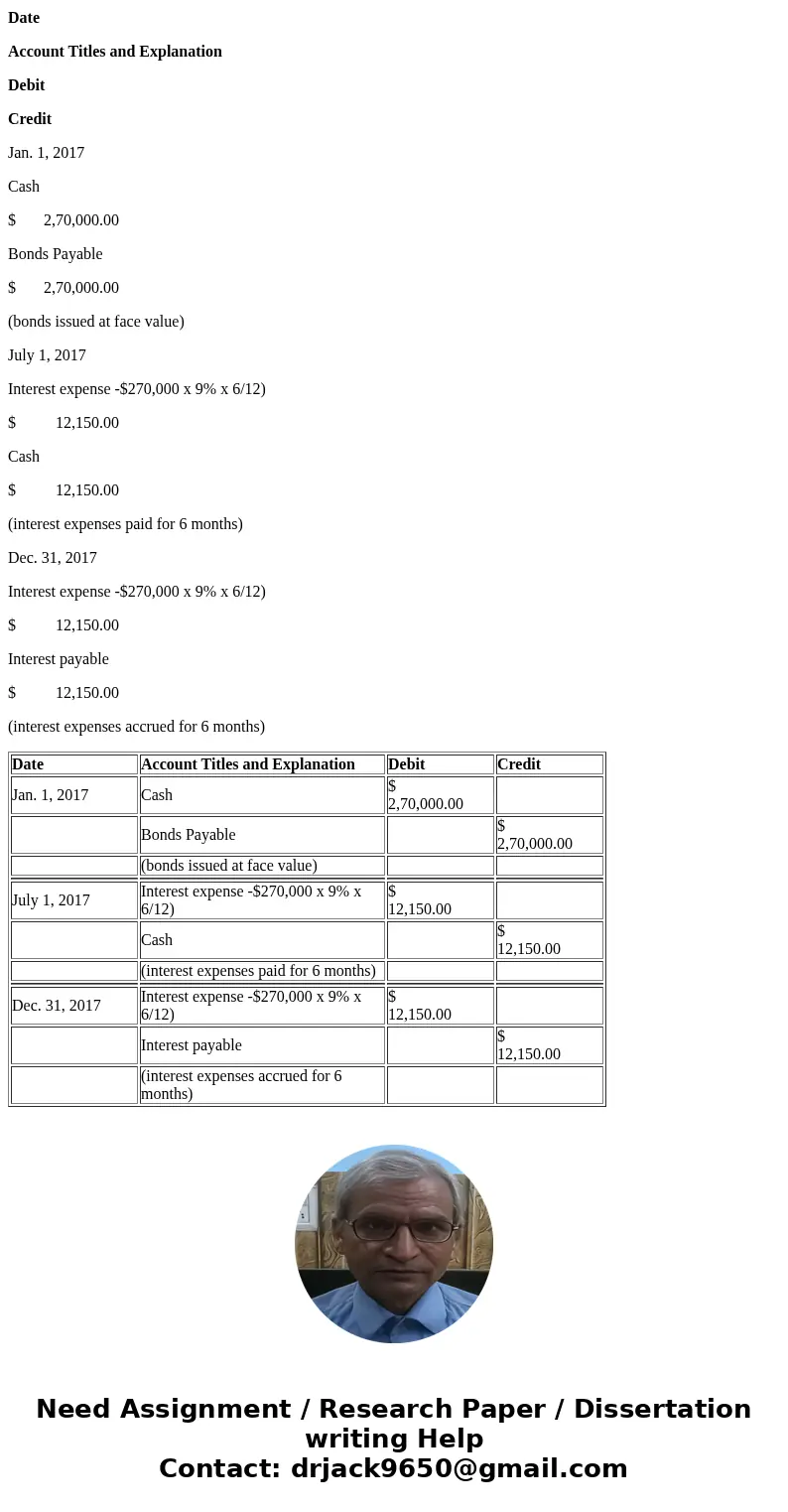

Solution

Answer

Date

Account Titles and Explanation

Debit

Credit

Jan. 1, 2017

Cash

$ 2,70,000.00

Bonds Payable

$ 2,70,000.00

(bonds issued at face value)

July 1, 2017

Interest expense -$270,000 x 9% x 6/12)

$ 12,150.00

Cash

$ 12,150.00

(interest expenses paid for 6 months)

Dec. 31, 2017

Interest expense -$270,000 x 9% x 6/12)

$ 12,150.00

Interest payable

$ 12,150.00

(interest expenses accrued for 6 months)

| Date | Account Titles and Explanation | Debit | Credit |

| Jan. 1, 2017 | Cash | $ 2,70,000.00 | |

| Bonds Payable | $ 2,70,000.00 | ||

| (bonds issued at face value) | |||

| July 1, 2017 | Interest expense -$270,000 x 9% x 6/12) | $ 12,150.00 | |

| Cash | $ 12,150.00 | ||

| (interest expenses paid for 6 months) | |||

| Dec. 31, 2017 | Interest expense -$270,000 x 9% x 6/12) | $ 12,150.00 | |

| Interest payable | $ 12,150.00 | ||

| (interest expenses accrued for 6 months) |

Homework Sourse

Homework Sourse